Loss of Earnings with 7 days deductible is back!

Loss of Earnings with 7 days deductible is back!

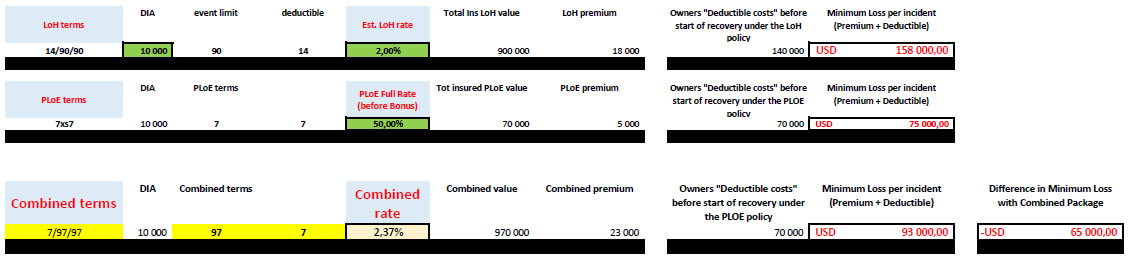

14/90/90 at 2.00% or 7/97/97 at 2.40% ... Should that be a question?

It means that, potentially, by paying an additional premium of USD 5 000, i.e.: USD23,000 instead of USD18,000, a ship owner can reduce the cash flow exposure following a H&M incident from USD 158,000 down to USD 93,000, NB: including the “additional” insurance costs.

The cash flow exposure during the first 14 days is, by far, the highest risk period, as any superintendent could confirm and as conventional LoH underwriters infer through not offering LoH cover with 7 days deductible.

The above is, I would say, a very strong challenge to the argument that buying Primary Loss of Earnings is an additional expense for a ship owner. Rather, it seems clear to me that the above example shows that in case of a H&M incident the Owner’s total costs will actually be reduced.

And, just in case you think such incidents do not happen to you, bear in mind that in the past 10 years, our underwriters have analyzed the H&M statistics of well over 1,000 shipowners in the process of assessing their risk profile and if possible propose terms.

Without a doubt, most of the shipowners have had claims that delayed the vessel in excess of a few days but often below 14 days.

At the end of the day, and statistics aside, basic common sense tells, clearly, where owners’ immediate and unavoidable financial losses occur.

Our underwriting process

Our underwriting process delivers a sustainable quasi-mainstream solution for the highest risk exposure, so I am always surprised to hear that there are owners for whom reducing their primary cash flow exposure from USD 140 000 to 70,000 USD at a cost of around 5,000 USD is still a question.

A cover that can be taken with or without conventional LoH cover being in place.

A cover that Nordic is the only insurer to provide, thanks to the exceptional underwriting performance, track record and professional diversity of the UW team’s profile.

As many of you know, I am a P&I claims veteran, Claudio Blancardi a reference for Delay insurance and a remarkable Hull Team headed by Jan Limnell, a reference in global markets, and including known professionals like Constantinos Elmaoglou, Yiannis Minovioudis and Mathias Lindqvist.